Looking across the Nordic landscape, 86% of the startups are tech-based, while the prominent categories of innovation differ between countries. In Iceland and Finland, most tourism and travel-related startups focus on mobility, while in Norway, Sweden and Denmark the top category is experiences.

The Nordic region is home to more than 10,000 startups and is one of the most active startup ecosystems in Europe. Startups have to stay ahead of the game, understanding where the key challenges and opportunities lie. As part of the XNordic Travel Contest, we have attempted to map all tourism- and travel-related startups in the Nordics to understand their key focus across the different Nordic countries and understand the scope and scale of the sector.

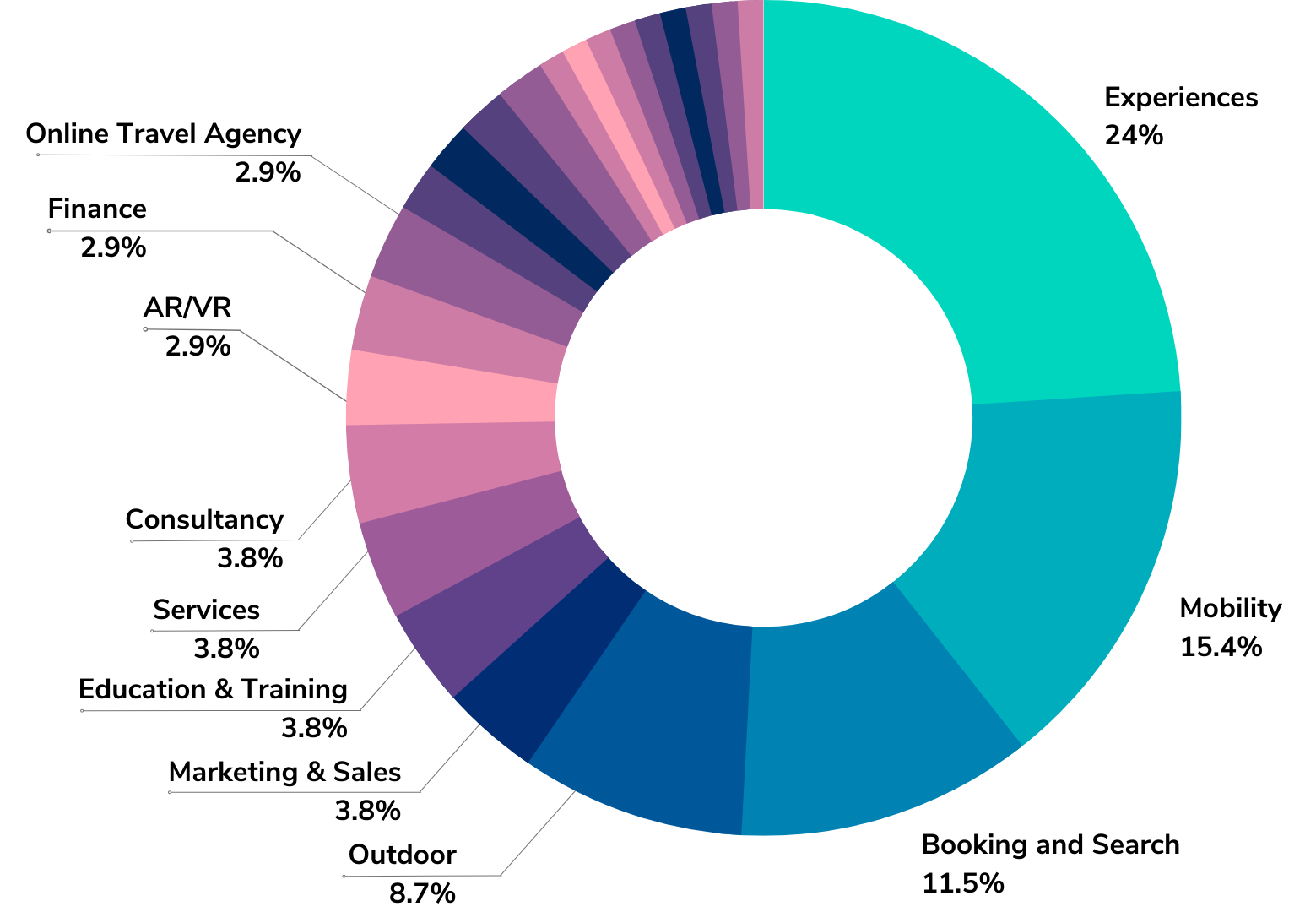

We will continue mapping and updating the landscape throughout the project. Until now, we have mapped 100+ Nordic startups across 15+ fundraising platforms and online startup communities including The Hub Danske Growth, Dealflow.eu and Tracxn among others as well as multiple research publications and reports such as Startup Blink Global Startup Ecosystem Index 2021, The Danish Startup Bible 2022 and Sweden Tech Ecosystem: Report 2021. The categories identified are also inspired by the categorization of these platforms and include Experiences, Mobility, Booking and Search, Outdoor, Consultancy etc.

Here are the key highlights of the mapping:

Experiences (Digital Guides, Guided Tours), Mobility (car-rental, bike-sharing), and Booking and Search are the top three categories among the Nordic startups. The pie-chart above summarizes the distribution across categories.

In Sweden, Denmark and Norway, Experiences is the top category of tourism- and travel-related startups.

In Iceland and Finland, more tourism- and travel-related startups seem to have a focus on mobility.

86% of the startups are tech-based, meaning 14% are non-tech startups.

Among the tech startups in our mapping, the majority of startups (32%) were Apps and 17% were Software as a service (SaaS) i.e. centrally hosted softwares licensed on a subscription basis.

Almost 50% of non-tech startups in our mapping are operating within the Experiences category (mostly Guided Tours) while the rest focus on Consultancy, Finance, Education and Training and Manufacturing/Production.

In the outdoor sector, startups are primarily concentrated in RV/Camping, Kayak rentals, Offbeat trips and other adventure activities.

This mapping will be an ongoing exercise and we will update this, as we discover new tourism- and travel-related startups in the Nordics to include. Let us know, if you know of a start-up we missed – or reach out with input and ideas!